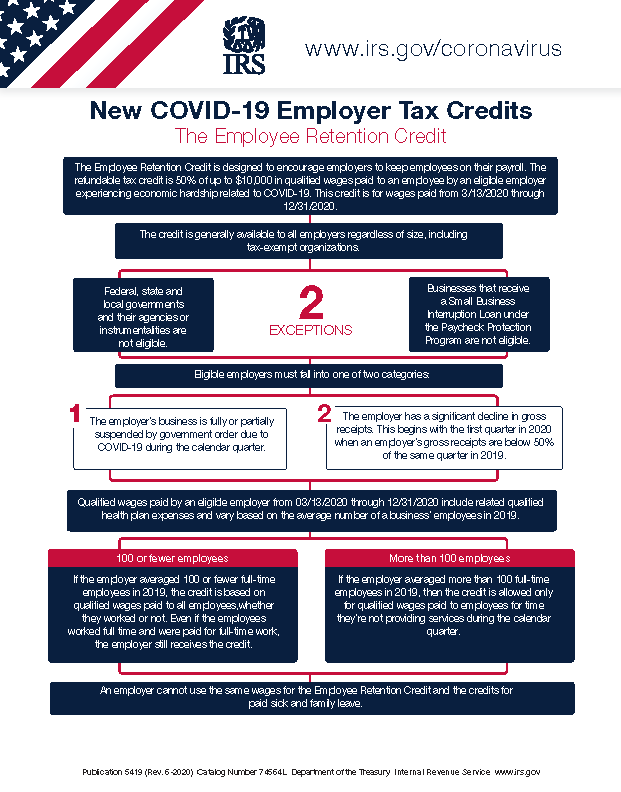

The IRS has revealed new COVID-19 tax credits for employers of any size, including those that are tax-exempt organizations. For wages paid from March 13, 2020 through December 31, 2020, an employer can receive a refundable tax credit of 50% up to $10,000 in qualified wages paid to an employee. It also includes related and qualified health plan expenses.

This tax credit has been made available to employers experiencing economic hardship related to the pandemic. The IRS has stated that this employer tax credit is applicable to companies of any size and organizations that are non-exempt with the inclusion of two exceptions:

- Federal, state and local governments and their agencies or instrumentalities

- Business receiving Small Business Interruption Loans under the Paycheck Protection Program (PPP)

Those that are eligible are employers whose business is suspended by the government due to COVID-19 during the calendar quarter, as well as employers who have experienced a significant decline in gross receipts, 50% or higher decrease, from Q1 2020 in comparison to Q1 2019.

Amounts vary based on the size of the company, with a threshold of fewer than 100 employees and more than 100 employees put into place. Please refer to the infographic from the IRS for all exceptions and guidelines regarding the tax credit.

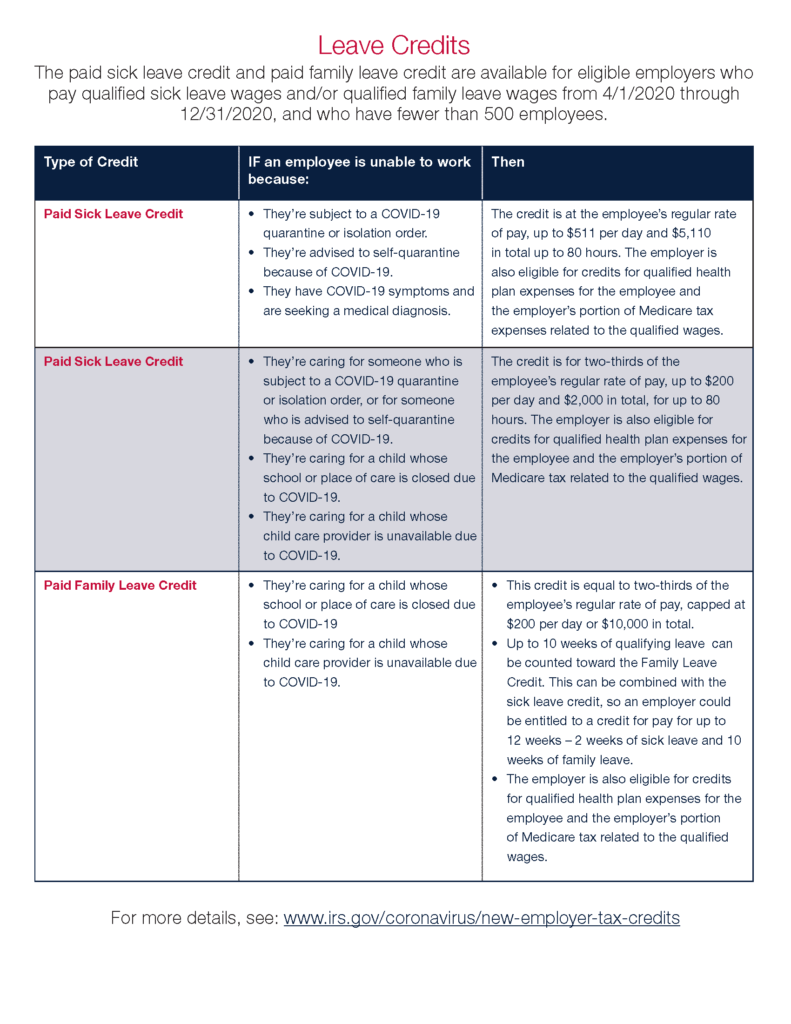

Additional tax credits are available for paid sick leave (PSL) and paid family leave for employers with fewer than 500 employees who paid leave wages from April 1, 2020 through December 31, 2020. The credit varies based on the type of leave and the circumstances of the employee using the leave. Please refer to the infographic from the IRS for more information regarding leave credits.

If your business is experiencing economic hardship and looking to reap the benefits of the new COVID-19 Employer Tax Credits, please contact your service team at CTBK for guidance with financial planning and tax preparation. To learn more about these tax credits directly from the IRS, visit www.irs.gov/coronavirus/new-employer-tax-credits.